There are several ways to get portfolios/models added to your account. One way is to set up a data integration that will automatically pull over all accounts. You can see instructions on how to do that HERE or go directly to the Orion Risk Intelligence Integrations page. If you are working with a client/prospect and want to add their holdings, please follow the client workflow seen HERE.

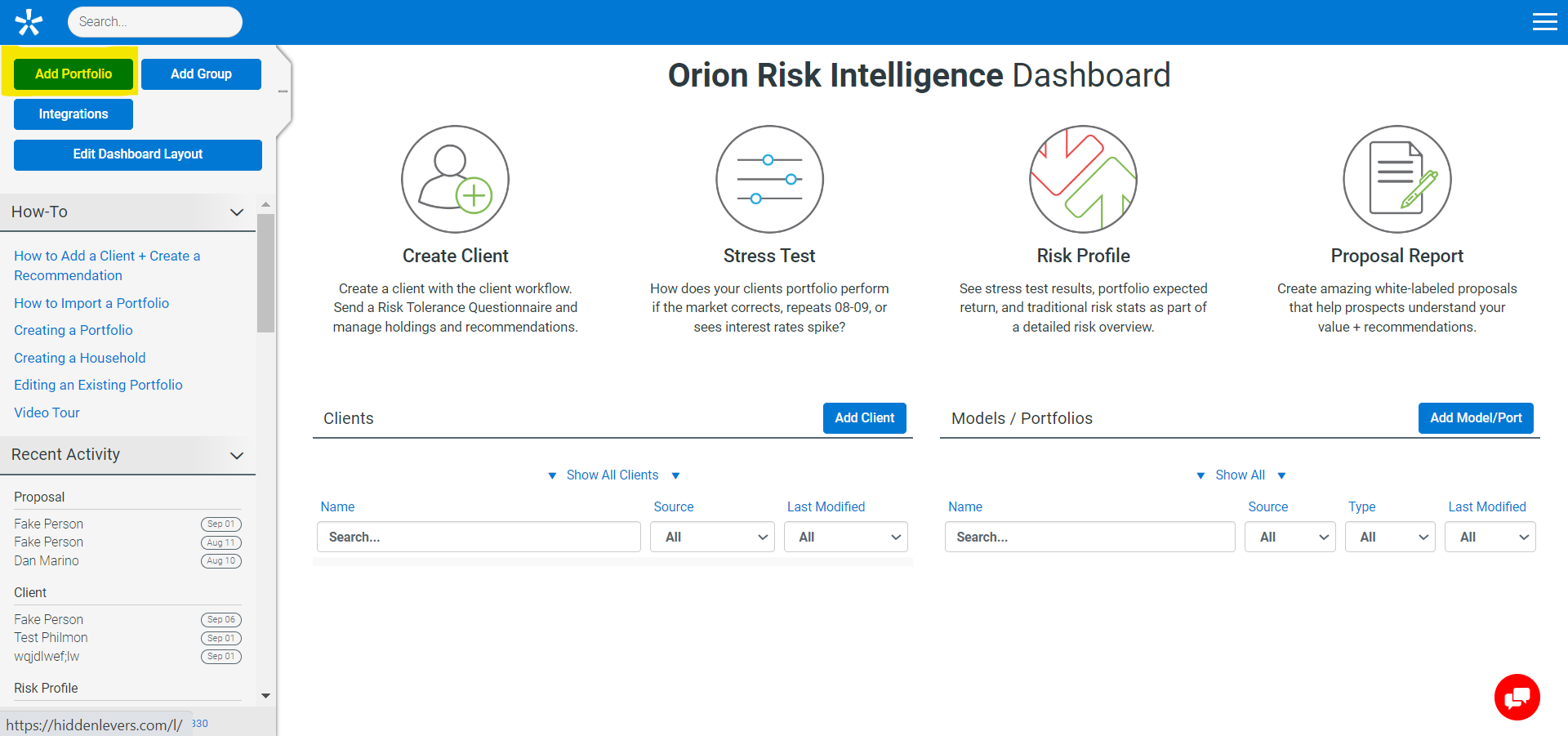

Here's a step-by-step guide to build out a portfolio from scratch: after you log into Orion Risk Intelligence, click the blue “Add Portfolio” button to begin.

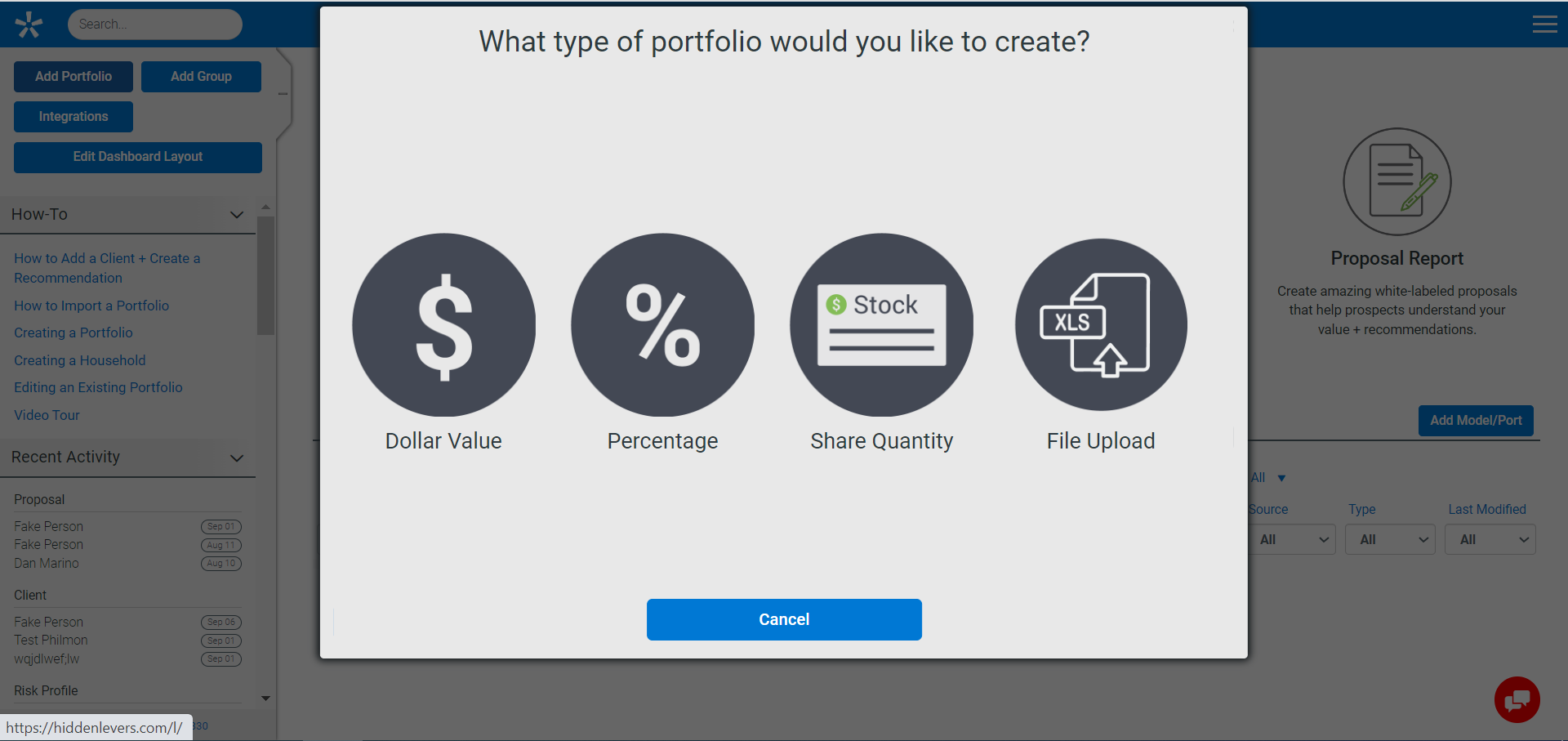

The first prompt is to have you select the portfolio type. You can create a portfolio by dollar value, percentage, share quantity or directly upload an Excel file. Please note that if you are creating a model, it can only be percentage-based. In this case, we will choose % allocation.

Now, on the edit portfolio modal, we can start entering the information for the portfolio. First, let’s give it a name. Then, we can start typing in the positions. This page functions like an Excel where you can directly copy/paste as well. Make sure to check the "Model" box if you would like to use it as a model. You’ll notice that the risk/reward arrows automatically update on the right as does the asset allocation with each additional position. You can learn more about the risk/reward arrows HERE.

If you want, you can add an AUM fee to this model in the Fee % field. The blue buttons represent other investments that do not have normal ticker symbols. We will go over them now.

Add Cash – This adds the Orion Risk Intelligence symbol for cash, FX:USD, to your portfolio. Please note that this symbol reflects the USD Index and changing in the dollar’s strength. To model cash as a flat instrument, please use a money-market fund.

Annuities – Where you can build annuities and access the annuities you’ve already built. Creating an annuity.

Custom Assets – Where you can access the custom assets in your system. Learn how to create a custom asset HERE

Fixed Income – Where you can build fixed income instruments and access those you’ve already created. This is used for non-traded REITS, CDs, BDCs, bonds, and other yield-type instruments. Please note that you can enter bond CUSIPs directly into the symbol column. Adding a fixed income position.

Options - Where you can build options. How to Model Options Contracts

Add Model - Simply search for the name of the models that you have built out in the system.