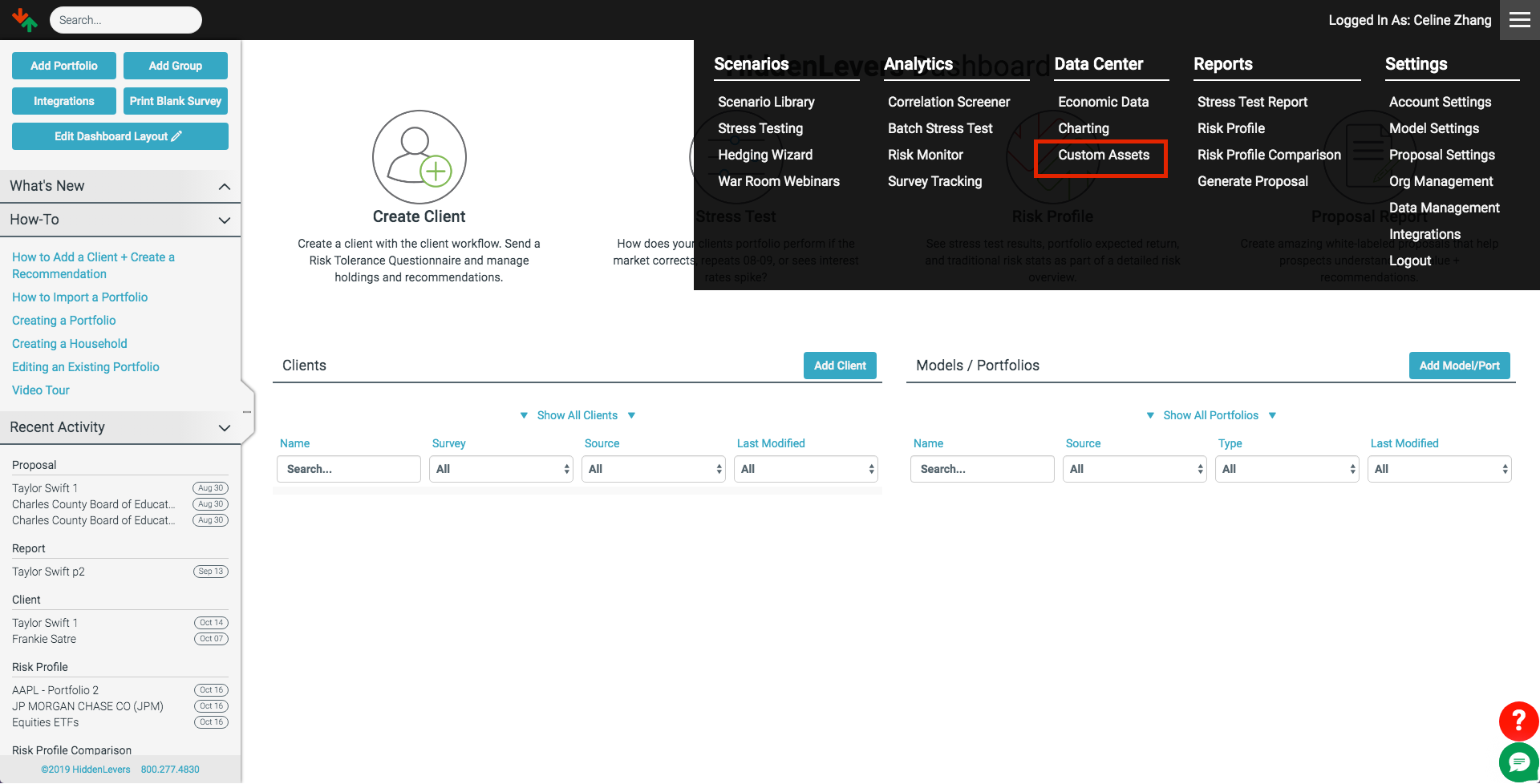

The HiddenLevers system can model fixed income and cash-flow investments (non-traded REIT, CD, preferred share, BDC) in a portfolio. To add a fixed position to a new portfolio, first log in to your HiddenLevers account and navigate to Data Center at the top and select Custom Assets.

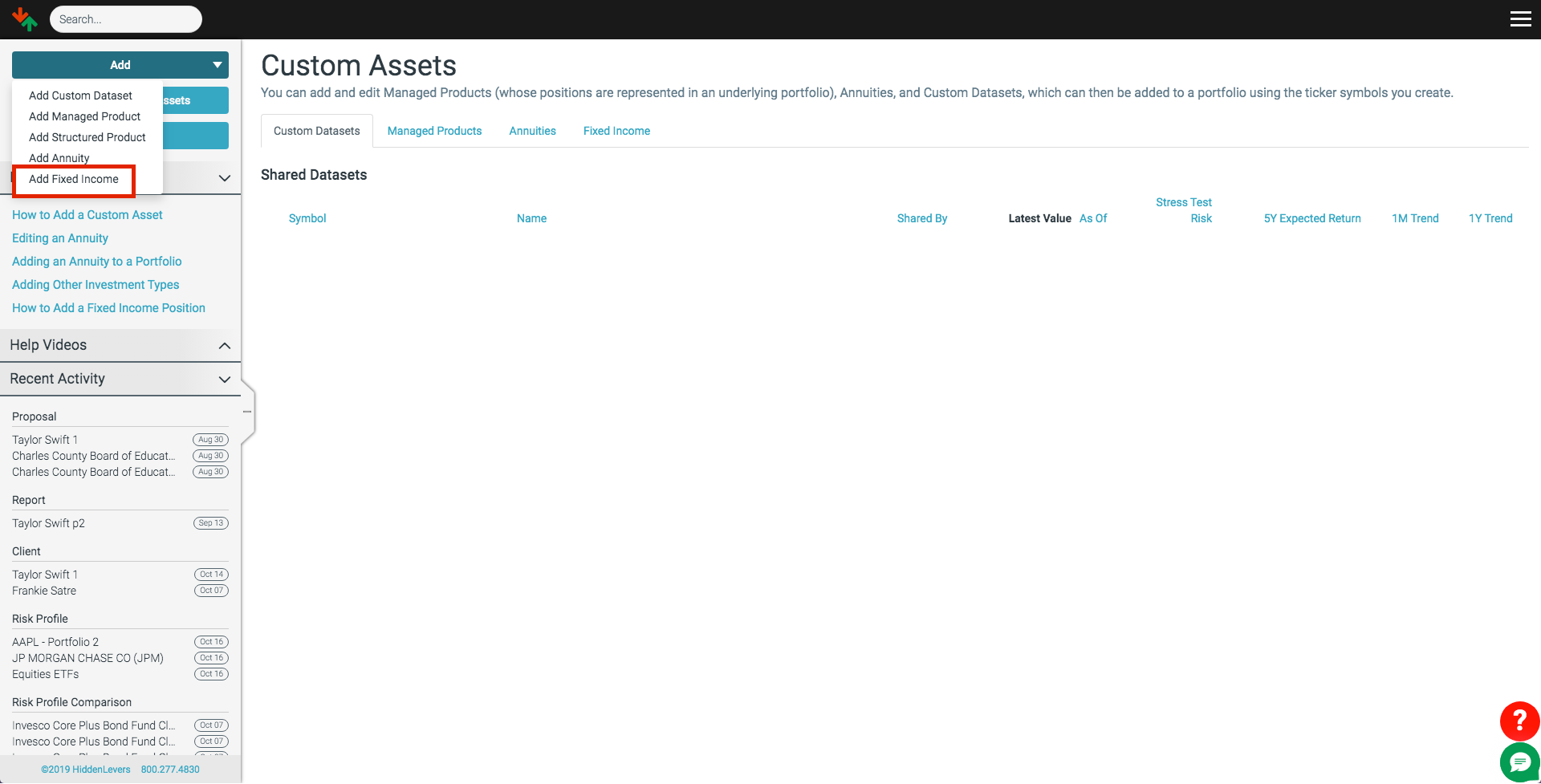

Then, open the "Add" dropdown and click on "Add Fixed Income."

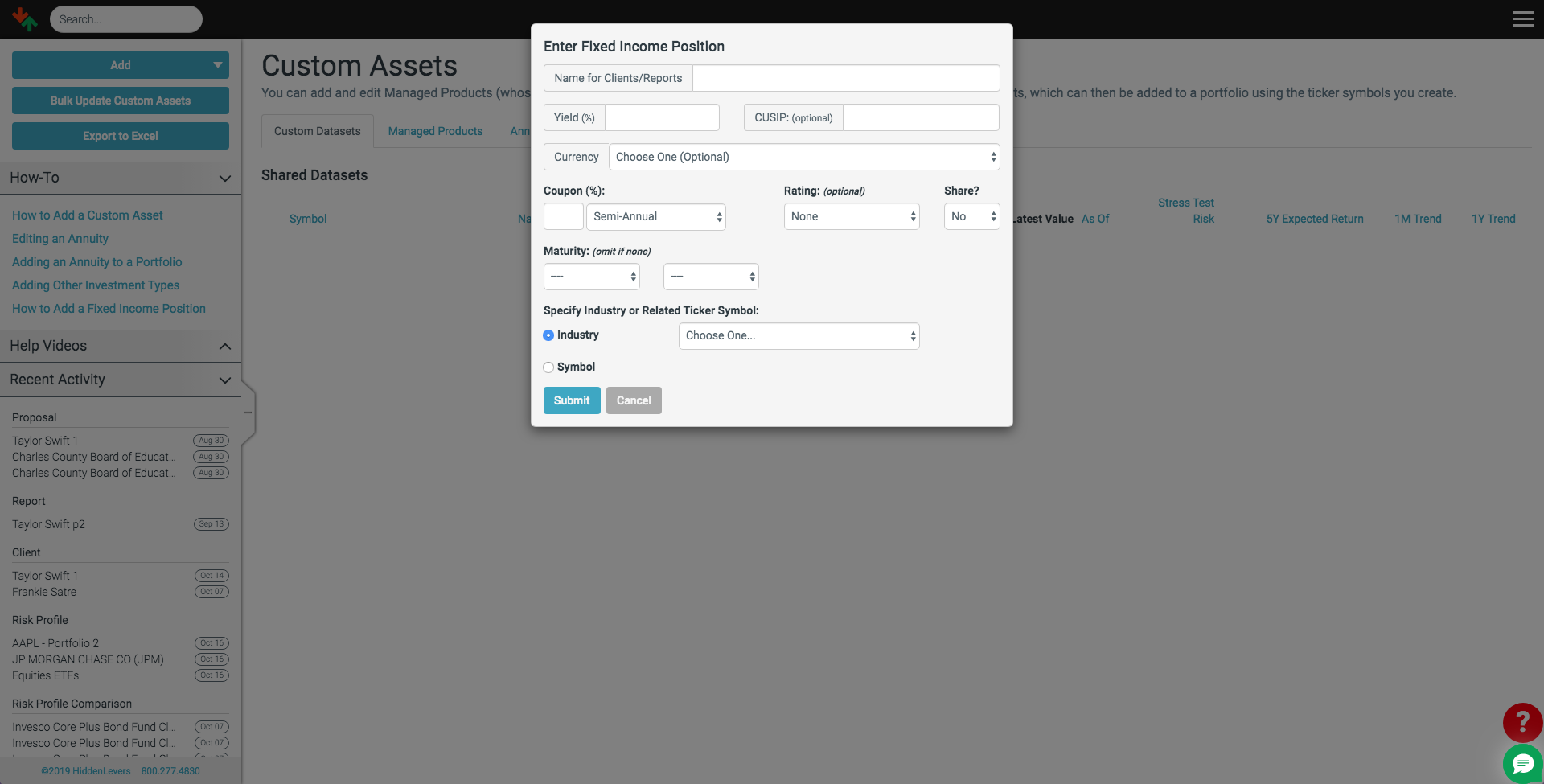

The Fixed Income creator will pop up, where you can enter the details of the Fixed Income instrument.

Now, enter the appropriate values for each field.

Name for Clients/Reports - A unique name for the holding which will appear on any reports.

Yield (%) – The yield to maturity, or current yield if there is no maturation.

CUSIP (optional) – You may add a CUSIP if you desire

Currency – The default is USD, you may select another currency if needed.

Coupon – Enter the annual coupon %. Also select the frequency of the coupon payment.

Rating (optional) – Credit rating, which affects interest rate sensitivity.

Share? – Do you want to share this instrument with others in your firm?

Maturity – When does the fixed income mature? Leave blank if no maturation.

For BDCs and REITs, you can select the appropriate Industry from the dropdown. For example, if the holding is for a fund made up of real estate investment trusts that specialize in residential properties, setting the "Industry" to "REIT - Residential" will allow us to model the behavior for the holding more accurately

For Preferred Shares and Corporate Bonds, you can select the underlying stock of the issuing company.

Once we have the details for our position entered, clicking on the blue "Submit" button will enter the data into the HiddenLevers database and generate a unique identifier for your holding that you can use in other portfolios. The format of the unique identifier is FI followed by a six digit number.

HiddenLevers supports industry-level historical data for fixed income and preferred investments. The proposal sections (historical graph, total return, annualized return, drawdown, investment growth, and risk measures) reflect both the equity and fixed income portions of a portfolio.

This price history is automatically set based on the general sector of the investment. Here are the current mappings:

- Any US Treasury fixed income will use the Barclays 3-7 Year Treasury Bond data for price history.

- Municipal fixed income uses Barclays Capital Municipal Bond data.

- Preferred instruments use iShares S&P U.S. Preferred Stock data.

- Other fixed income instruments use Barclays US Aggregate data.

These are the defaults, but they can be changed in your Model Settings.