How does Real Estate Modeling work?

The way we stress test Real Estate is similar to how stress test other assets. For a better understanding of how the model works in general check out this help article.

Where as our stress testing model for equities will look across more than 130 economic indicators to determine meaningful relationships, the real estate model examines a handful.

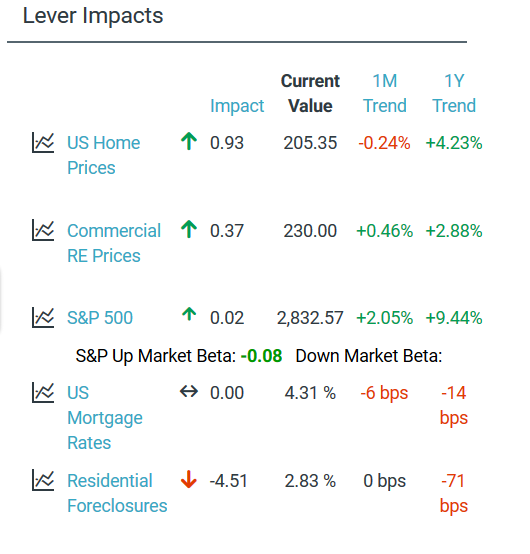

For real estate the HL model is concerned with U.S. Home Prices, Commercial RE Prices, US Mortgage Rates, Residential Foreclosures, and the S&P 500.

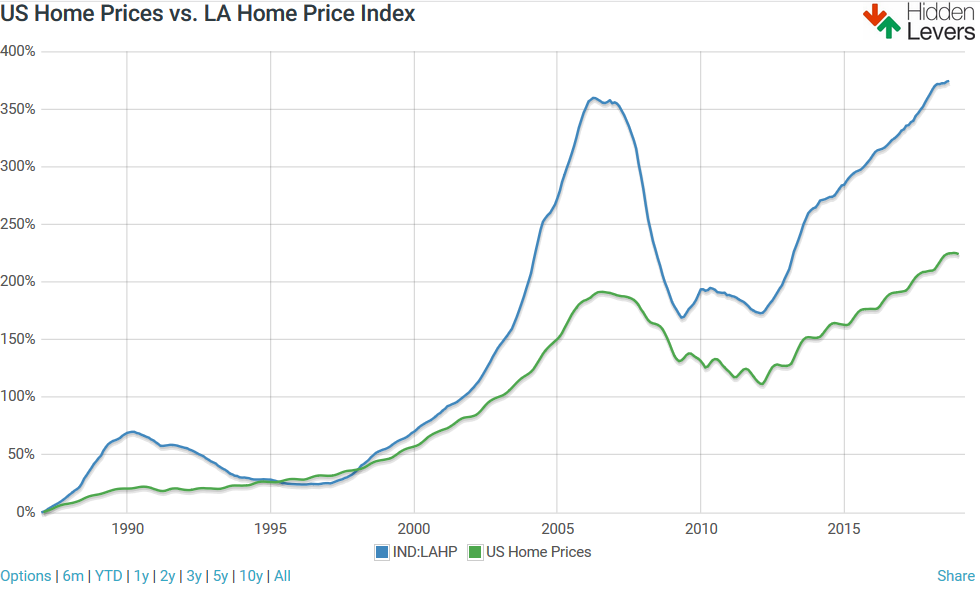

Similar to how our model will crunch the relationships across those 130+ indicators for standard assets, the real estate engine determines a city’s Home Price Index’s relationship to those factors. For Los Angeles that looks like this:

In the example below we’re looking at a single factor:

You’ll notice LA home price’s have a much higher Beta to US home prices in general. Anecdotally that makes sense!

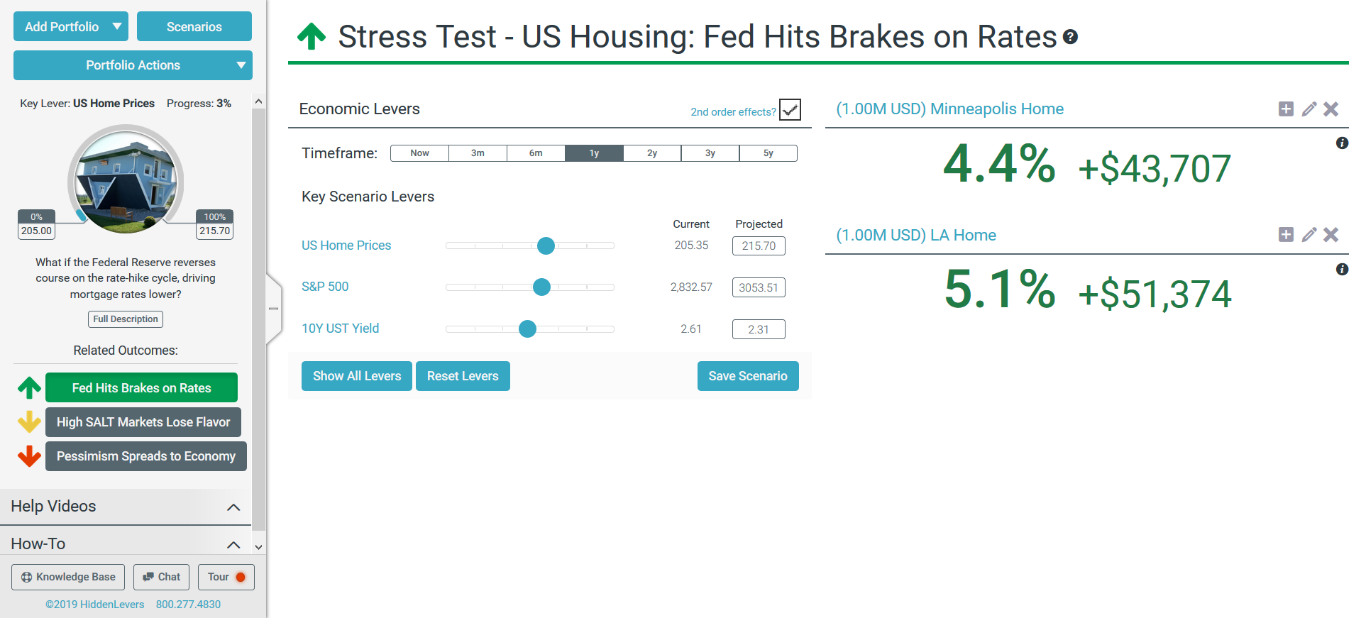

How does this look in stress testing?

There’s three additional layers that are crucial to how we model real estate: Mortgage Rate, Leverage + Cap Rate.

Mortgage Rate: Pretty self-explanatory--this is the interest rate charged on the mortgage. While your stress testing the property the mortgage rate reduces your return as you go further out in time. NOTE: This will only effect real estate with a cap rate entered.

Leverage: This is the difference between the property’s value and the mortgage balance. The more leverage you use, the more risk that property will carry; it will also have a better upside potential. So, if you’re 80% leveraged (IE only put 20% down on a home) if the home value goes up 1% your return would be 5%.

Cap Rate: The rate of return that is expected to be generated on a real estate investment property. Capitalization Rate = Net Operating Income / Current Market Value. For personal properties enter a 0 here or leave the field blank. You can think of this as a dividend you receive, and it models similar to how we handle dividends today. As you push the timeline out on stress testing, your return will increase by the Cap Rate per year.